Breaking News – Rishi Sunak Update

open businesses which are experiencing considerable difficulty will be given extra help to keep staff on as government significantly increases contribution to wage costs under the Job Support Scheme, and business contributions drop to 5% business grants are expanded to cover businesses in particularly affected sectors in high-alert level areas, helping them stay afloat and […]

The Job Retention Bonus – Are you Eligible?

With the law in the form of a treasury direction being published alongside the HMRC guidance, we can now successfully help you understand whether your company is eligible for the Job Retention Bonus. Employers who are eligible to claim the bonus for employees must keep individuals who are under the CJRS employed until January 31st […]

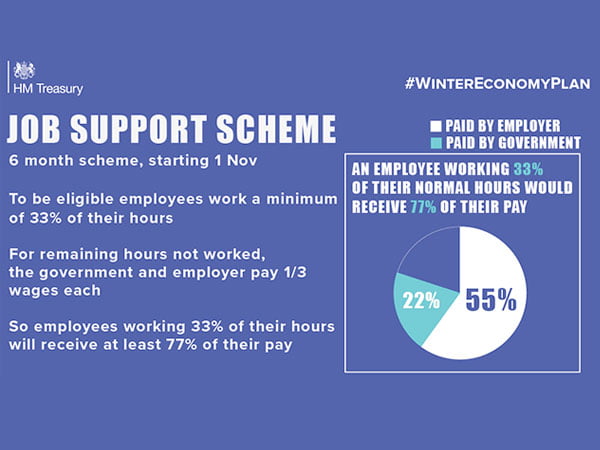

Are you eligible for the new Job Support Scheme?

HMRC has confirmed that the final date to submit your claims under the Coronavirus Job Retention Scheme (CJRS) will be on 30th November 2020. After this date, no more new claims can be submitted or added to any previous claims. The scheme finally comes to a close at this end of October since it began […]

CJRS Bonus: Update

employers can claim the bonus for all eligible employees who have been furloughed it comes as employers set to start contributing to the furlough scheme as staff return to work and the economy reopens The bonus – announced by Chancellor Rishi Sunak as part of his Plan for Jobs last month – will see […]

Green Stimulus Package

The chancellor announced plans to seize the coronavirus crisis as an opportunity to green the economy. He announced a £3bn package of green investment to help create thousands of jobs and to make public sector buildings greener. Homeowners will receive vouchers of up to £5,000 — and £10,000 for poorer households — to pay for […]

VAT Cut

What’s happening? At the moment, VAT (value added tax) relating to these sectors is charged at the standard rate of 20% that applies to most goods and services. But now the government has said that for the next six months it is cutting VAT on food, accommodation and attractions from 20% to 5%. VAT is […]

Kickstart Scheme

The kickstart scheme will help those aged between 16 to 24. The fund will subsidise six-month work placements for people on Universal Credit in the age group who are at risk of long-term unemployment. Mr Sunak told the Commons: “The kickstart scheme will directly pay employers to create new jobs for any 16 to 24-year-old […]

Eat out to help out

Diners will get a 50% discount off their restaurant bill during August under government plans to bolster the embattled hospitality sector. Chancellor Rishi Sunak unveiled the “eat out to help out” discount as part of a series of measures to restart the economy amid the coronavirus pandemic. The deal means people can get up to […]

Stamp Duty Holiday

The Chancellor has granted a stamp duty land tax holiday to homebuyers in England and Northern Ireland with immediate effect. It means that buyers of homes valued at up to £500,000 will no longer pay any stamp duty on the purchase. In a bid to boost a housing market still in shock from the COVID-19 […]

Rishi Sunak Summer Statement

Rishi Sunak has announced a wave of sweeping measures to kickstart the UK economy in his mini-Budget – here’s what they are. Announcing his Summer Statement in the Commons today, Sunak pledged to pause stamp duty, boost hiring, slash VAT, and introduce “eating out” vouchers for every person in the UK.“Despite the extraordinary support we’ve […]