Rishi Sunak Extends Furlough Until March 2021

Rishi Sunak Extends Furlough Until March 2021 The scheme which helps pay up to 80% of workers’ wages, will now be extended until March 31st 2021. Unfortunately, this does mean the job retention bonus will be put on hold, meaning companies will no longer be able to claim £1,000 per employee until next year if […]

Will you miss out on the £1,000 Job Retention Bonus?

Are you aware of the Job Retention Bonus (JRB) which allows employers like you to earn £1,000 per employee? Did you also know that thousands of companies are simply missing out because 1) they don’t know it exists and2) those who are aware miss out on a technicality. Rest assured we have all the answers. […]

Furlough Extended

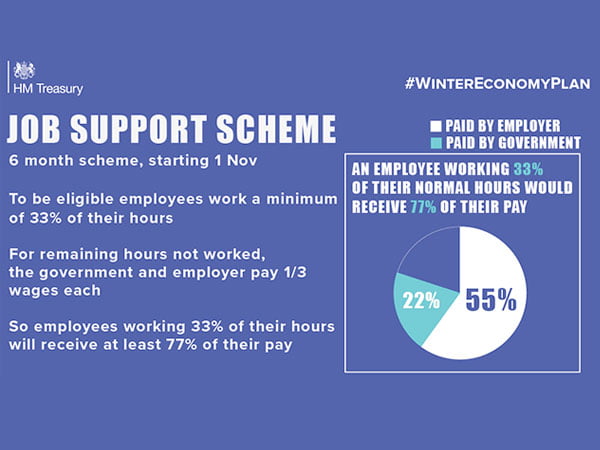

HMRC have published full guidance on the Job Support Scheme which was due to come in to force from 1 November, but has been postponed. On Saturday 31 October, on the eve of JSS go live, the Prime Minister, Boris Johnson, announced that there would be another period of lockdown in England, beginning on Thursday […]

Breaking News – Rishi Sunak Update

open businesses which are experiencing considerable difficulty will be given extra help to keep staff on as government significantly increases contribution to wage costs under the Job Support Scheme, and business contributions drop to 5% business grants are expanded to cover businesses in particularly affected sectors in high-alert level areas, helping them stay afloat and […]

The Job Retention Bonus – Are you Eligible?

With the law in the form of a treasury direction being published alongside the HMRC guidance, we can now successfully help you understand whether your company is eligible for the Job Retention Bonus. Employers who are eligible to claim the bonus for employees must keep individuals who are under the CJRS employed until January 31st […]

Are you eligible for the new Job Support Scheme?

HMRC has confirmed that the final date to submit your claims under the Coronavirus Job Retention Scheme (CJRS) will be on 30th November 2020. After this date, no more new claims can be submitted or added to any previous claims. The scheme finally comes to a close at this end of October since it began […]

CJRS Bonus

Today the Chancellor announced the introduction of the Job Retention Bonus. This is a one-off payment of £1,000 to employers that have used the Coronavirus Job Retention Scheme (CJRS) for each furloughed employee who remains continuously employed until 31 January 2021. The bonus will provide additional support to retain employees. To be eligible, employees will […]

Deadline for placing employees on furlough fast approaching

Companies intending to furlough employees for the first time under the Coronavirus Job Retention Scheme (CJRS), must do so by 10 June 2020, in order to observe the three-week minimum furlough period ahead of 30 June 2020, prior to the implementation of the changes to the scheme from July – October 2020. On 29 May […]

Incorrect refusal of Coronavirus Job Retention Scheme Support

HMRC has released Insolvency Guidance which confirms that claims relating to the Coronavirus Job Retention Scheme (CJRS) which have been rejected because the claimant is in arrears with their tax liabilities, should not have been rejected. HMRC has been notified that there have been instances where claims relating to the CJRS have been rejected because […]

Statutory Sick Pay extended to individuals who are shielding

New Regulations due to come into force on 16 April 2020 mean that any person classed as extremely vulnerable and at very high risk of severe illness from coronavirus (COVID-19), and who have been advised to remain at home for at least 12 weeks will be entitled to Statutory Sick Pay (SSP). The process is […]