National Insurance changes from 6th November 2022

It was always expected that any changes to legislation that affected payrolls would always happen at the start of a new tax year. Changes that happen mid-tax year are not helpful to both businesses or payroll bureaux.

6th April 2022:

Increase in both the employee and employers’ National Insurance contributions by 1.25%. However, this was welcomed by an increase to the employee’s primary threshold in line with the income tax personal threshold at £12,570 on 6th July 2022.

Both the above were a precursor to the introduction of the Health and Social Care Levy (HSCL) from April 2023.

The Government have now reversed both the rate increase AND the HSCL. These changes come into effect on 6th November 2022.

What is changing?

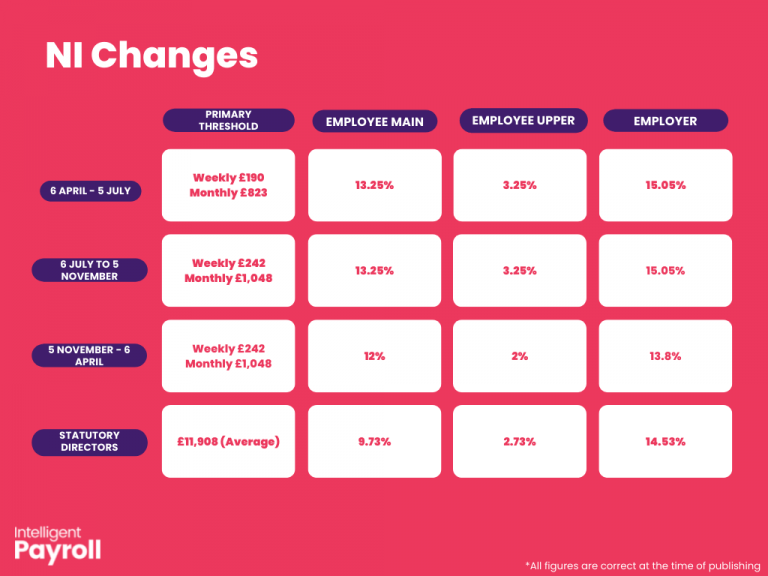

The amount of NIC that both the employee and employer pay will reduce on all earnings from 6th November 2022 – the exact percentages are shown in the table below.

Statutory Directors have NIC calculated on an annual earnings period and therefore the rates at which they pay National Insurance is an average.

This is 12.73% and 2.73% for Employees National Insurance and 14.53% for Employers National Insurance.

There are some things to be aware of here, if a statutory director is only paid once a year in the April to November period (or paid large bonuses in the same period), they are likely to have overpaid both employees and employers NI.

HMRC have yet to clarify how this should be adjusted.

What do employers need to do?

Any clients using our payroll services do not need to do anything as our software has already been updated to account for the changes.

However something that you may need to consider is that statutory directors are listed as such on the payroll, this is easily checked through logging in and checking the team member record area.

If you use another payroll provider or process payroll in house, please ensure you check that the directors have been flagged as directors on the payroll.

If you are still unsure about this, please do get in touch here.

The payroll solution that your team has been waiting for.

For more information, contact us today or book a demo.